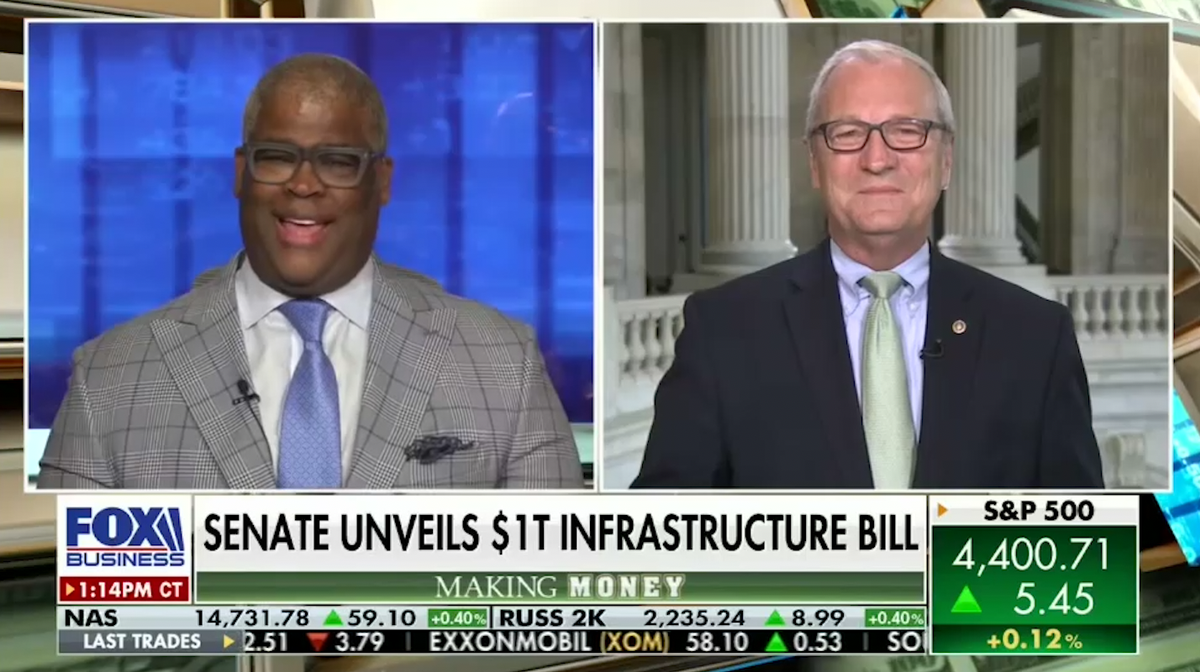

Source: United States Senator Kevin Cramer (R-ND)

WASHINGTON – U.S. Senator Kevin Cramer (R-ND), a Senate Budget Committee member and Ranking Member of the Senate Environment and Public Works (EPW) Subcommittee on Transportation and Infrastructure, joined Charles Payne on Fox Business this afternoon to discuss the bipartisan infrastructure package, Democrats’ tax-and-spend agenda, and the debt ceiling. Excerpts and the full video are below.

On Next Steps for Infrastructure:

“We’re going through it line by line at this point. … We’ll look for things like on the permitting reform side, making sure that things like the One Federal Decision provisions that we put in the EPW bill are still in there, making sure categorical exclusions for permitting, that the permitting council is a major part of it. … There are just a lot of those nuanced things we’re looking closely at.”

On Democrats’ Spending Package:

“Whether we pass this one [infrastructure] or don’t pass this one, they will muscle the [spending bill] through. The difference being, if we pass a trillion dollar package that actually has spending constraints, that actually has infrastructure as its focus the profitability of the private sector, I think you have taken a lot of the low-hanging fruit out of a human infrastructure bill. I think it makes it more difficult frankly for them to pass it.”

On the Debt Ceiling:

“I don’t know a single Republican who would be supportive of a clean raising of the debt ceiling. … We have to have a serious discussion about the debt and deficit on both sides of the ledger, both discretionary and mandatory side of the ledger. A lot of us are prepared to do that. I’m on the TRUST Act with [Senator] Mitt Romney, which gets to the foundation, I think, of the mandatory spending side. That is an unpopular side politically to talk about, but as you know, these trust funds are coming up on insolvency — not a long ways, but within a decade.”