Source: United States Senator for North Dakota John Hoeven

Senator Marks Final Purchase of Coal Creek by Rainbow Energy, Outlines Nearly 15 Years of Effort to Crack the Code on CCUS

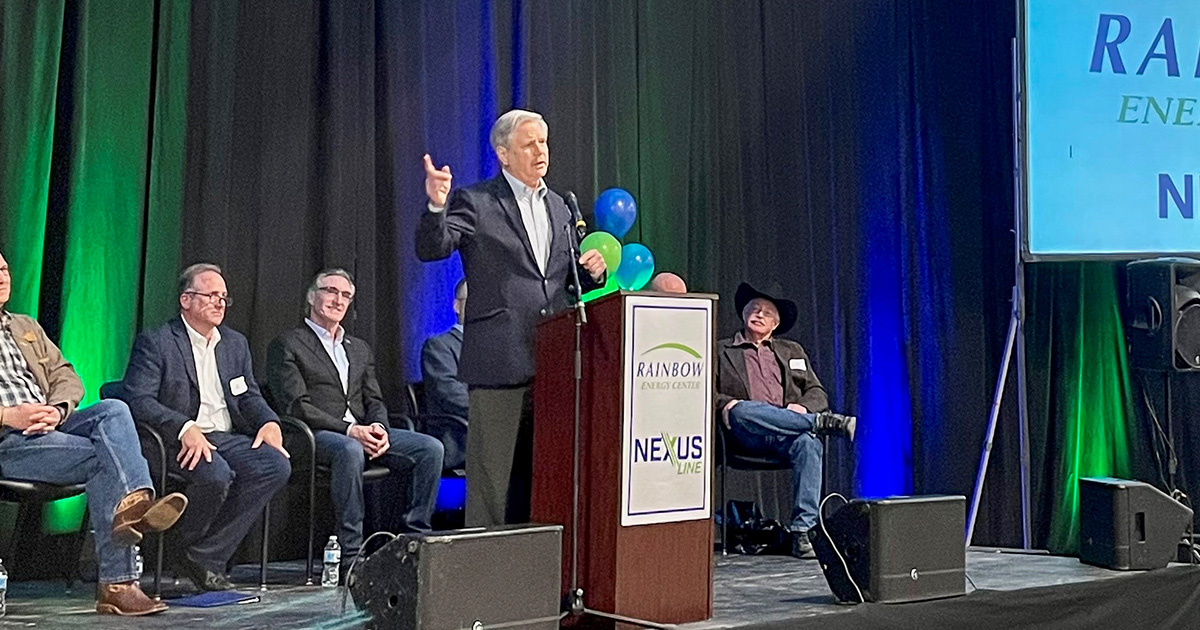

UNDERWOOD, N.D. – Senator John Hoeven, a member of the Senate Energy and Natural Resources Committee, today marked the final sale of Coal Creek Station to Rainbow Energy. Hoeven worked with Great River Energy, Rainbow Energy, North American Coal and the state’s leadership to identify and secure this solution to keep the plant and adjacent Falkirk Mine in operation. In particular, the senator’s efforts to crack the code on carbon capture, utilization and storage (CCUS) are a central part of supporting Coal Creek’s future operations and were key to the sale being finalized.

Hoeven has been advancing the state’s leadership in CCUS for nearly 15 years, having worked:

- As governor to create the regulatory framework for carbon storage in the state, starting with the North Dakota CO2 Storage Workgroup he established in 2008. Following this:

- He advanced a bill through the state legislature to grant authority over carbon storage to the North Dakota Industrial Commission.

- The state enacted legislation that granted ownership of the pore space to the owner of the overlying surface estate.

- Then as a U.S. Senator, Hoeven secured approval of the state’s application for regulatory primacy over geologic storage of CO2using Class VI wells. North Dakota is one of only two states to have this regulatory authority.

- To get the 45Q carbon capture tax credit implemented in a way that provides a revenue stream to make CCUS projects more commercially-viable.

- To fund critical loan guarantees from the U.S. Department of Energy (DOE) and U.S. Department of Agriculture (USDA).

“For nearly 15 years, we’ve worked to crack the code on CCUS and make North Dakota a prime location for the development and implementation of this technology. This will enable America to continue utilizing all of our abundant energy resources, including coal, to support both economic and national security,” said Hoeven “CCUS was a key part in helping this sale move forward, and we look forward to Coal Creek Station and Falkirk Mine providing good-paying jobs, along with affordable and reliable power, for years to come.”

Securing the 45Q Tax Credit

The 45Q tax credit provides an important revenue stream for CCUS projects of up to $50 per ton for CO2 permanently stored, or up to $35 per ton for CO2 stored and used for enhanced oil recovery. After helping pass legislation to reform and expand the 45Q tax credit, Hoeven worked to advance its implementation. His efforts included:

- Working closely with the Trump administration to move the final 45Q regulations forward.

- Passing legislation providing a two-year extension of the construction deadline for the 45Q tax credit.

Cracking the Code on CCUS

Moving forward, Hoeven is advancing the following priorities to crack the code on CCUS, which will enable the nation to continue making use of its abundant energy resources, including coal:

- Front end investment in technology development, including bolstering the partnership between DOE and the University of North Dakota’s Energy & Environmental Research Center (EERC).

- Loan guarantees to help project developers secure financing to build the equipment and infrastructure needed to capture and store CO2.

- Enhancements for the 45Q and 48A Advanced Coal tax credits to provide important revenue streams to project developers and encourage adoption of CCUS:

- Sponsored legislation to modernize the 48A tax credit for CO2 capture retrofit projects.

- Helped introduce a bipartisan bill to provide a direct payment option for the 45Q and 48A CCUS tax incentives.

- Joined legislation to increase the value of the 45Q tax credit and make it more accessible to CCUS projects of all sizes.

-###-