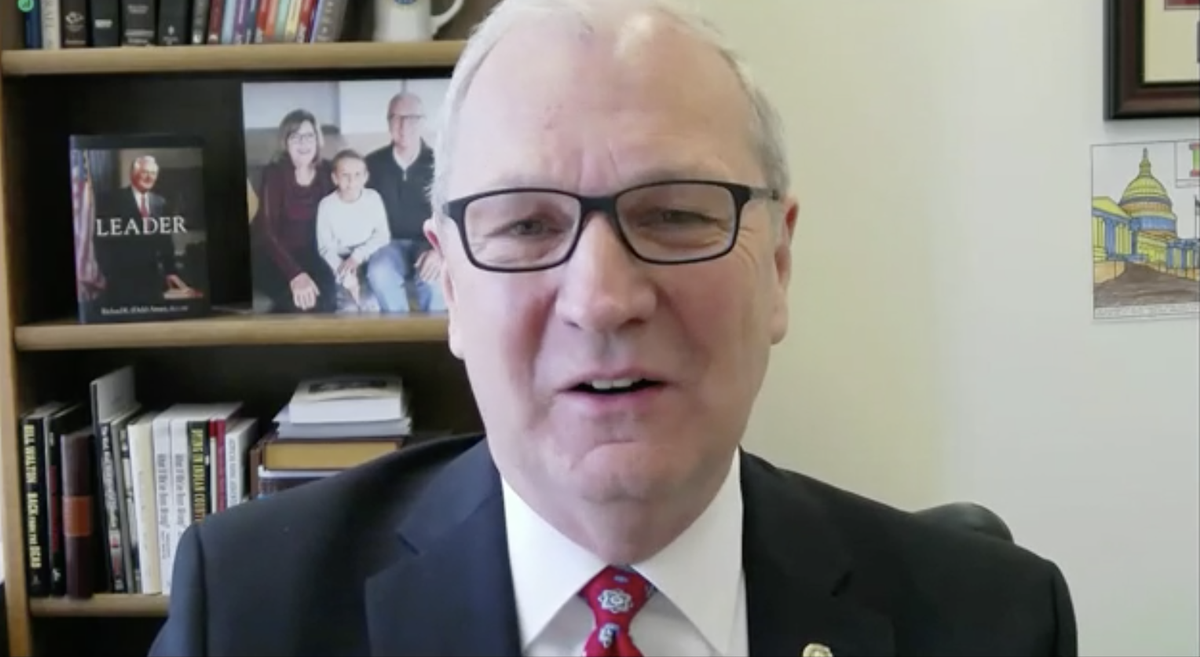

Source: United States Senator Kevin Cramer (R-ND)

WASHINGTON – U.S. Senator Kevin Cramer (R-ND) questioned Sarah Bloom Raskin, nominee to be Vice Chairman for Supervision and a Member of the Board of Governors of the Federal Reserve System, at a Senate Banking Committee hearing today. The senator focused his questioning on her extreme views on climate finance and her attempts to explain away those disagreements.

“In your exchange with Senator Kennedy, you were trying to explain the context of your editorial relating to risk in the oil and gas industry, in particular, the fossil fuel industry, in particular. I went back and read that same piece after the exchange to familiarize myself with the content and the context. You’re right in that you were writing in response to the expansion of the Main Street Lending program that we worked hard to get. The oil and gas industry is a huge jobs industry and huge national security industry in our country was being set aside and ignored, if you will, by the Main Street Lending Program. And yet we were building bridges for all kinds of other industries, none more important than the oil and gas industry,” said Senator Cramer.

“But as I read the piece you did not confine your advice or opinions to simply the Main Street Lending Program. There was no strategic ambiguity whatsoever in your statements. I’m very concerned going forward not just because there’s a single nominee that shares these views that you share so vehemently and so rigorously, but rather there have been lots of them in lots of areas and lots of agencies—and more than one or two in various positions with various positions in the Federal Reserve… I have great concern about your position and the increased power you want to give to the Federal Reserve as it relates to allocating capital away from legal commerce,” continued Senator Cramer.

The senator then asked Mrs. Bloom Raskin about the role banks play in ideologically picking winners and losers in the energy sector.

“I want to flip the script a little bit on you and ask if you think it is a risk banks ought to consider if a market they support has a less than reliable resilient supply of energy. If you’re Texas or other parts of the South or the Southwest that has failed resiliency tests in recent times; Or the Northeast or California where they have gone away from baseload electricity for example and replaced it with more intermittent forms of electricity that people actually die when that electricity doesn’t work during cold times; Or manufacturing has to be curtailed during certain times because they are very energy-dependent. Is that a risk you think banks ought to consider and the Fed ought to keep an eye on?” asked Senator Cramer.

Mrs. Bloom Raskin skirted the senator’s direct question and focused on her personal views of the Federal Reserve, which according to Congress is a dual mandate of maximum employment and price stability.

“The Federal Reserve—as far as I know—is not looking to expand its powers. The Federal Reserve has very clear mandates that Congress has provided. The Federal Reserve always needs to always act within those parameters. It is absolutely critical to independence… It is not a regulator and supervisory function for a regulator to take over the basic business decision that the bank is making… I certainly appreciate the fact and the cardinal principle that the Federal Reserve does not exist to be favoring any sectors. And the regulatory approach should not be in any way choosing certain sectors over others,”replied Mrs. Bloom Raskin.