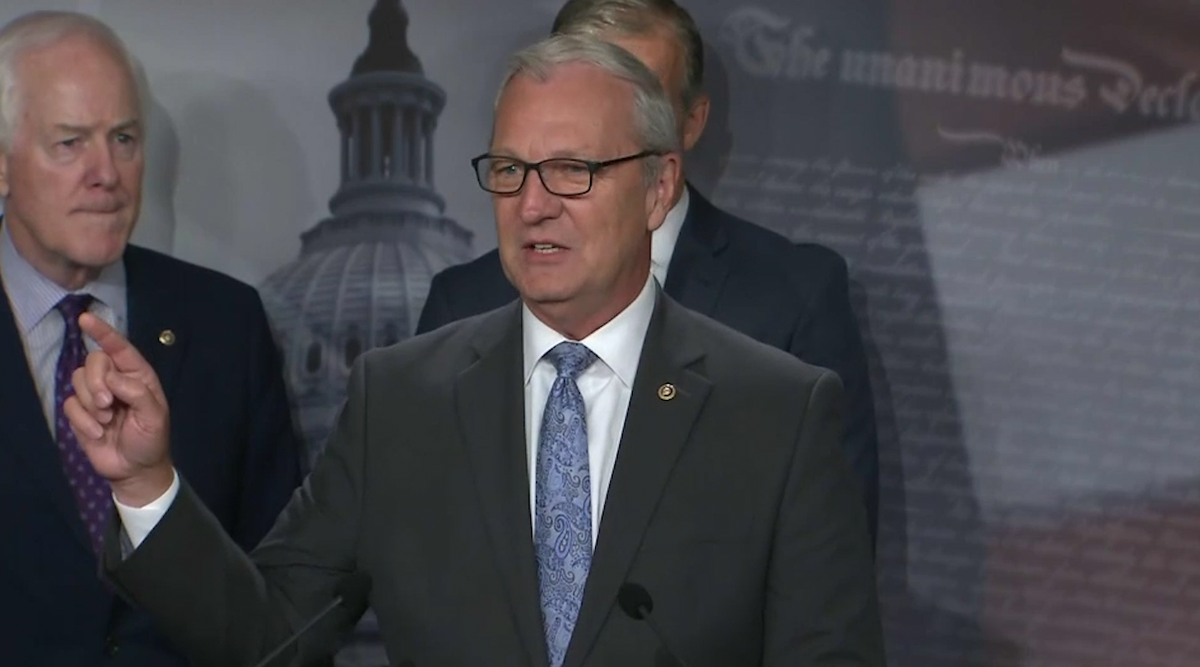

Source: United States Senator Kevin Cramer (R-ND)

“It would not be unusual for a great-great-grandfather to have purchased land at $20 an acre. It would not be at all unusual that today that would be worth $2,000 an acre. If you eliminate step-up in basis, if you have 100 acres valued at $2,000 an acre, you are suddenly taxing a whole bunch more money that no one did a thing other than produce food for a hungry world on for five generations.

“[Farmers’] input costs have been sky-rocketing, thanks to inflation. The prices, frankly, they have been getting for the last several years have not been all that great, not to mention things like floods and droughts and hail and the other things that make farming so difficult. But let’s just double the tax on the increased amount that [farmers] aren’t getting any more money for. That is what the capital gain tax proposal does.

“Worse, after all of that, if in fact there is an estate tax bill that comes due that is based on a lower threshold than what we are talking about today that means more of the estate is going to be taxed, if in fact it changes hands between generations.

“Suddenly you have an outcome that’s not just a farmer with a $725,000 tax hit, you have a farmer who has to sell his family farm just to stay alive. That should not be anybody’s goal, and I’m embarrassed that it is. Maybe they just don’t know, but now they should.”